In a world where search companies are a dime a dozen and brands tout bland “unique selling propositions” that aren’t unique at all, how can you avoid drowning in the sea of sameness? What are you doing that’s any different from every other SEO firm?

In this article, you’ll learn how to find, activate, and articulate your competitive advantage. You’ll discover how to identify unique strengths and innovative offerings that equate to competitive advantage through real, working examples so you can bring them to life in search. And finally, you’ll get actionable tips and homework to help your business stand out.

The state of our industry

“SEO is dead.” Have you ever heard this eye-roller before? This is a common refrain in the search industry every time Google takes more precious real estate into its clutches and away from website owners, when our tactics become less impactful, when Google increasingly automates answers and paid search efforts, or as we watch the internet become inundated with “content for SEO” that’s drowning the best content out. It’s enough to make any search expert feel like it’s impossible to win.

But I argue that search and content marketing aren’t dead. Far from it. Google is still the main place people turn to for information and answers, and humans will continue to search. However, the industry is becoming increasingly commoditized, and it provides challenges and lessons that can change the landscape for our industry and many others.

I conducted an informal survey of more than 100 digital marketers around the globe, asking whether they believe our field is becoming commoditized. Of those, more than two-thirds said content marketing is moderately or highly commoditized, nearly 73% said the SEO industry is commoditized, and nearly three-quarters said the paid search space is becoming moderately or highly commoditized.

Barriers to competitive advantage

The trouble with the commoditization of an industry is that it makes it difficult for any business to stand out. It gets harder to stay competitive, which makes it harder for a business to grow. This isn’t entirely surprising, because achieving real, sustainable competitive advantage is no easy task.

The reasons people say it’s hard to stay competitive in their industry range from knowing what opportunity is available to own, to challenges being able to innovate rapidly enough, to internal barriers like buy-in or fear of risk-taking. According to my survey, some of the most common barriers to competitive advantage are:

- Knowing what opportunity makes sense to try to own

- Prioritizing billable client work over non-billable brand-building work

- Time, bandwidth, and budget

- An internal fear of or aversion to taking risks

- Cultural challenges like buy-in

- Overcoming customer perception of the brand’s position

- Lack of focus and slowness in innovation

- Competitive advantage is a changing, moving target

While the survey I conducted was limited to digital marketers, nearly every business vertical experiences commoditization and competition. Our client brands are fighting it, too. But without truly understanding competitive advantage — much less how to find, prove and defend it — we risk drowning in that sea of sameness. I’ll continue to use digital marketing professions like search and content as working examples, but know that the principles here can benefit you, your clients, and your business, regardless of industry. It could even help you assess your individual competitive advantage to help you land a dream job or get that big promotion.

What is competitive advantage?

There are a few traits professionals agree on, but the open-ended survey answered revealed a lot of disparity and confusion. Let’s try to clear that up.

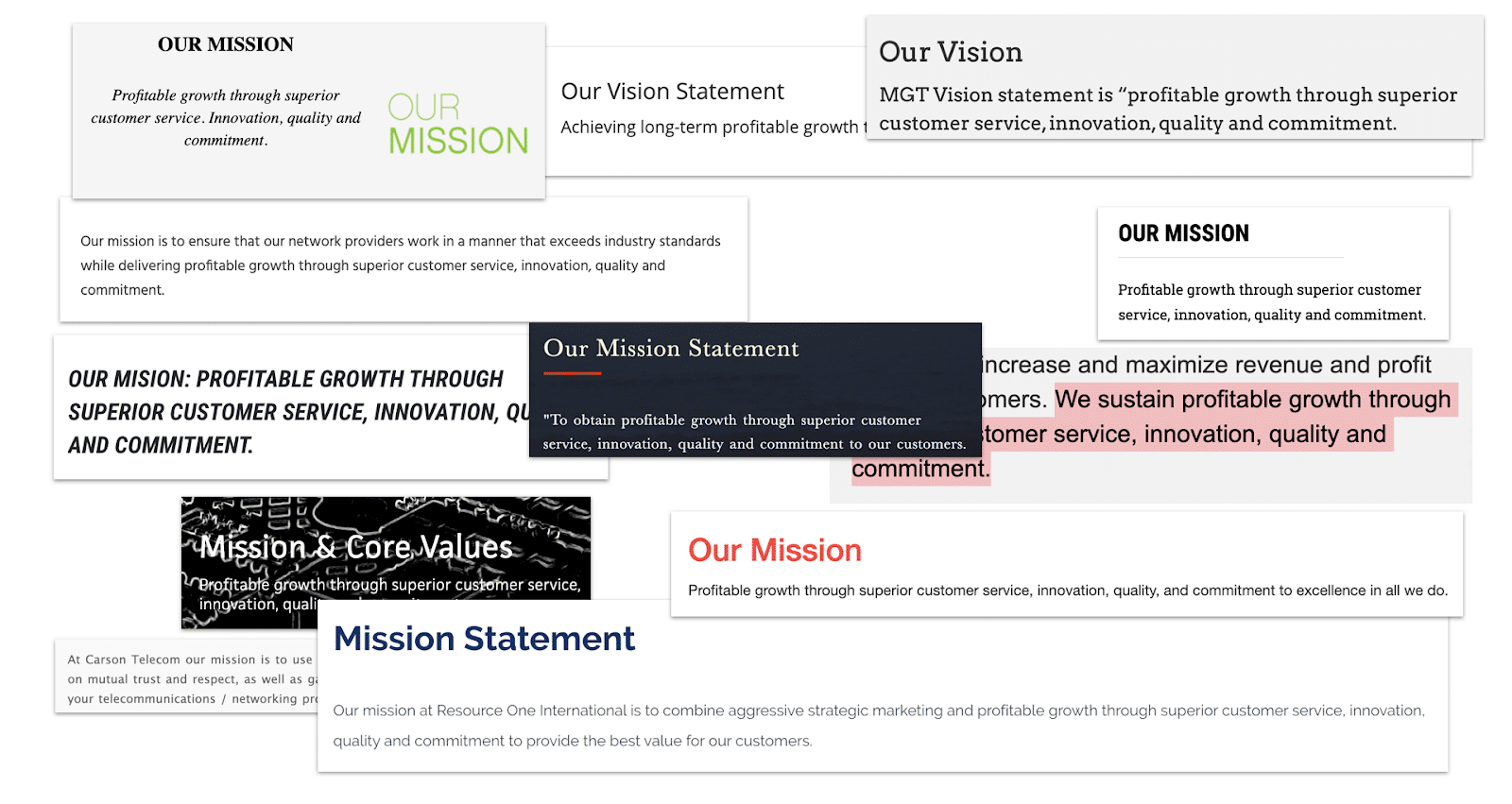

Often when we talk about a brand’s competitive edge, we talk about mission and vision statements. But the sad truth is that many, many businesses are claiming competitive advantages in meaningless mission statements that aren’t competitive advantages at all. Let’s look at an example: “Profitable growth through superior customer service, innovation, quality and commitment.”

This is a commonly used example of a bad mission statement for many reasons – it’s vague with no specificity whatsoever, it has a long list of intangible advantages with no focus, and these things every business should probably be doing. These are table stakes. You could copy and paste any brand name in front of this. In fact, I found a dozen companies in just the first two pages of search results that did exactly this, even though this is heralded as a prime example of a meaningless mission statement.

And if the meaningless mission statement wasn’t persuasive enough, let’s also examine what many brands consider their “unique selling propositions.” I actually object to the “unique selling proposition” or “USP,” because it’s all about the brand. I much prefer “UCB,” or unique customer benefit, which puts the customer at the center, but I digress.

Let’s take a look at a few examples in the invoicing software space. In fairness, the brands below do list other benefits on their sites, and many are good, but this is often what they lead with. FreshBooks says they have invoice software that saves you time, Invoice2Go says they have time-saving features that keep you in control, and Sliq Tools can help you organize and speed up invoicing.

Saving customers time is important, but the problem is that none of these offerings aren’t unique. Nearly every invoicing software I looked at highlighted some version of speed, saving time, and getting paid faster. These are all valuable features, but what’s the benefit that’s going to make the customer choose you?

Let’s take a look at three more. Invoice Simple says you can invoice customers in seconds. Xero gives you a real-time view of your cash flow. Scoro says they can help you stop using and paying for six or more different tools.

These benefits are a lot more clear. Invoice Simple says they don’t just save you time, but they help you get invoices done in seconds. That specificity puts it over the edge. Xero’s real-time view of cash flow is incredibly important to businesses; the ability to see and make decisions from that information immediately is very valuable. And Scoro’s benefit of cutting back your tool stack really hit home. It’s very common for SMBs to add one tool at a time over time and then find that they’re drowning in accounting software, and maybe they’re making more mistakes or just losing time to keeping up with it all.

5 components of competitive advantage

Start with your “est.” Best. Fastest. Smartest. Cheapest. Most innovative. Most horizontally integrated. What is something that better delivers more value to customers, or comparable value for a better price? This is a great brainstorming exercise to ask yourself initially what you are or want to be best at. Keep in mind, maybe it’s not the “est” over all – maybe it’s the “est” for a specific segment of your audience or need state of your customer or even just a geographic region. But then you have to check those “ests” against a few criteria to ensure it’s really a competitive advantage.

Unique

Is your advantage unique? If anyone can claim the same thing, it’s not unique. Your advantage should serve a unique need, a distinct audience, or deliver your product or service in a unique way. Dig deep to find something specific and tangible that sets you apart from your competition.

Defensible

A defensible advantage is a distinct, specific claim that is not generic or vague, and avoids superlatives. If you can copy and paste any brand name in place of yours, it’s not defensible. Make sure your unique benefit or advantage is clear and specific. Avoid superlatives and hyperbolic language that can’t be quantified in any way. The typical mistake I see is generic language that doesn’t paint a picture for customers as to what makes you special.

Sustainable

Meaningful competitive advantage should be lasting and endure over a long period of time. I frequently heard in the survey that people believe they have competitive advantage for being first to market with their type of service. That does confer some benefits initially, but once the market figures out there’s money to be made and little competition, that’s when they swoop in to encroach. First mover advantage is a competitive advantage for a while, but it is not a sustainable competitive advantage. If you can’t hold onto that competitive advantage for a while, it’s too short-term.

Valuable

Something the customer feels is a greater value than competitors. If your customer doesn’t care about it, it’s not valuable, and thus it’s not a competitive advantage. What your business does isn’t solely defined by what you sell, but rather by what your customer actually wants. (And in the search business, that’s especially true – if people aren’t searching for it, it’s not valuable to the business.) Your customer has to feel that what you offer is a greater value than your competitors. That can be a product, service or feature at a comparable price that excels, or it can be a comparable product, service or feature at a better price.

Consistent

Competitive advantage must be something you can bring to life in every aspect of your business. This is why typical CSR (corporate social responsibility) fails to be an adequate competitive advantage for many brands. They put a page on their website and maybe make a few donations, but they’re not really living that purpose from top to bottom in their organization, and customers see right through it. It can’t be a competitive advantage on the website that isn’t also reflected at the C-level, with your sales reps who work with customers, in your factories, and so on.

For all their flaws and my moral beef with Jeff Bezos, Amazon was unwavering in their commitment to fast, affordable shipping. That’s what turned them into the monolith they are today. People know that Ben & Jerry’s is vocal and activist in all aspects of what they do, and they live up to the promises they make.

A competitive advantage framework

One of the most important attributes to understand about competitive advantage is that it’s temporary. It’s a moving target, so you can never get too comfortable. The moment you identify your competitive advantage and you’re enjoying nice profit margins or share of voice in a space, competitors will start racing to take advantage of new learnings themselves. This leads to eventual parity among competitors, and the cycle starts again.

So you need to figure out where to evolve or re-invent to stay competitive. This is a handy little framework for finding, establishing, articulating and maintaining your competitive advantage. But note that this isn’t purely linear — once competitors encroach on your previous advantage you’re at risk of losing it, so be sure to look ahead to what your next competitive advantage can be OR how you can elevate and defend the one you already have.

Discover: tools to find your competitive advantage

Discovering what makes you different is half the battle. In an increasingly crowded and commoditized competitive landscape, how do you figure out where you can win?

Ask

The number one recommendation from my survey is to ask. Tools from formal surveys to in-depth interviews, to casual feedback forms and ad hoc conversations can reveal some very insightful advantages. The objective is to figure out why you over someone else. A few things you might ask them:

- Why did you hire us over another firm?

- Why did you hire another firm over us?

- Why did you choose to leave us and switch to another firm?

- Why do you continue to work with us after all these years?

Look for patterns. Your competitive advantage might be hiding in there — or insight into your competitor’s advantage.

Listen

Try listening quietly, too. Check conversations on Reddit, Nextdoor or relevant forums where people have frank dialogue about problems they need solutions to, people recommending for or against brands, people are likely to be honest when helping their neighbors.

You can also read ratings and reviews on popular sites like Amazon or Yelp. Granted, it’s easy to fake some of these, but look for patterns in what people say about your brand, your products and services, or your competitors. What are their common complaints? What do other brands do poorly or not at all, gaps that you can fill?

Workshop

Getting experts with multiple perspectives in a room to workshop and brainstorm can also help uncover your competitive advantage. Evaluate your brand, your customers, your competition, the industry, new developments, and more. Also look beyond your own industry – often great ideas can come from entirely different verticals outside your own. Ask yourself hard questions about who you are, what you can commit to, and what you can follow through on to offer customers. I’ll share just two of many possible competitive advantage workshop tools below.

SWOT analysis

Conduct a SWOT analysis of your strengths, weaknesses, opportunities and threats – do the same for competitors. This is best conducted with people across multiple disciplines to consider different angles. It’s also key to do your research – look as closely at competitors as you do your own brand.

Strengths are the powerful capabilities and value you bring to the table. Weaknesses are the gaps in your resources or offerings that might hold you back from being best in class. Opportunities are untapped or unexplored areas of potential growth. Threats are outside forces or external factors that put your business at risk – like economic downturn and susceptibility global pandemic, for example, or the entry of a disruptive new competitor.

Porter’s 5 Forces Model

The second tool I want to introduce is Porter’s Five Forces model. Most folks who attend business school will learn about this, but you can also read about it in Michael Porter’s book Competitive Advantage. It’s a method to analyze the competitive pressures on your business. His model asserts that these five forces determine how intense the competition is, and thus, how attractive it is to enter an industry based on profitability. But it’s also a very valuable critical thinking tool even if you’re already in the industry to figure out where you can compete and edge out the opposition.

The first force at the center of the model is competitive rivalry. What is the quantity, quality, and diversity of your competitors in the space? How fast or slow is the industry currently growing? What’s the growth potential in the future? Are customers typically loyal to a brand, or are they brand-agnostic, switching a round frequently in your industry?

Then we have to think about the toggle between new entrants into the market, or the threat of substitute products or services. For new entrants, is it an easy industry to enter, or are there high barriers to entry? A brand with high threat of new entrants (low barriers to entry) might be food trucks. With some good recipes, enough capital to set up a high cost to start up, and some elbow grease, you’re in business. But industries with low threat of new entrants (high barriers to entry) might be things like airlines. It’s very expensive to buy planes and hire qualified pilots, and it’s an industry loaded with government regulations.

For the threat of substitutes, is there a high quantity of other products or services on the market your customer can choose from? Is it easy or hard to switch brands? Also, could there be an entirely alternative solution or abstention? For example, perhaps an alternative to highly commoditized toilet paper would be an alternative solution like a bidet like Tushy. Or perhaps a makeup brand like Sephora faces “substitution” from people who choose to abstain from wearing makeup at all.

And finally, we have to think about how well suppliers can bargain and how well buyers can bargain with your company. Every company has a supply chain, even service businesses like digital marketing.For manufacturing companies, suppliers might be the raw materials or transportation providers. For digital marketing companies, suppliers might be technology companies or the talent you hire to do the work.

If demand is greater than supply – either due to quantity of suppliers, the unique needs you have for securing that talent (like GMO-free, organic, locally sourced ingredients from companies that donate money to offset their carbon impact), this force has high-pressure. But if the resources you need are a dime a dozen (PC laptops come to mind), bargaining power of suppliers is low.

End users and buyers are part of your supply chain too. If they can easily “bargain” by choosing other competitors or driving down costs through competition, you have high pressure here. If you’re truly the only player in the market, or one of few, who do what you do, then bargaining power of buyers is lower. Also consider the cost of someone switching to another company or a substitute.

Define: choose your competitive strategy

Once you have found the gap you want to fill, you need to choose your area of focus. Often we make the mistake of trying to be all things to all people all the time. Brands can’t pull this off in a sustainable way forever. If you are trying to be adequate at everything, it’s difficult to be great at anything.

While not impossible, it’s very difficult to maintain deep focus on things when you are spread too thin. My MBA professors told me that smart strategy isn’t just choosing what you will do, it’s also choosing what you won’t do. That has stuck with me ever since. We need to make hard choices about where to spend time, budget, energy and attention. To get truly great at something, and achieve competitive advantage, you need to set your sights on something specific.

One problematic example I heard from a big client was challenging our Paid and Organic Search teams to win at efficiency and return on ad spend, while also winning on volume and share-of-voice concurrently. Efficiency and ROAS focus on a selective approach to advertising on certain terms or topics to optimize for the most efficient acquisitions and cost savings, and it often results in a narrower reach but highly efficient use of advertising dollars. On the flip-side, focusing on volume or achieving the largest share-of-voice in a space typically requires casting a wider net, and that traffic may convert at a lower rate and profit margins and ROAS may be tighter.

Another common challenge is trying to be a company or person who is both broad and versatile, while also being deeply specialized. This isn’t absolutely impossible, but maintenance and upkeep becomes challenging over time. If your brand wants to be perceived as the most versatile brand that can adapt to anything or meet everyone’s needs, it’s difficult to also be the brand that is perceived as deeply specialized in a certain field.

Let’s use grocers as a working example. WalMart may be the generalist for being able to get just about anything you could possibly want in one place, while Natural Grocers might be the deeply specialized whole, organic, local foods shop. Far less variety and versatility, but you can be assured they hit on certain quality and sourcing criteria within their more curated selection.

Consider what that means for you as a business or an individual professional.

Examine your brand and narrow your focus.

Let’s walk through a few of the questions you can ask yourself to closely examine your brand and narrow your strategic focus on a clear competitive advantage.

- What are the core activities that make up your business? Think about your core products or services, core audiences you serve, and core problems you solve.

- Who are the people the brand was created to serve? Consider the individuals, decision-makers, customers or firms you serve. Are they in certain industries or job titles? Where do they get their information? How can you best reach them where they are?

- What do your potential customers, or a specific segment of them, want or need? How does your brand, product or service solve that need? What do you enable them to do? What keeps them up at night? What problems do they have to solve or decisions do they have to make that you can help with? What are points of friction or frustration that you or your business are uniquely equipped to alleviate?

- What do your customers value? According to a book called The Purpose Advantage by Jeff Fromm and his team, the business you’re in is defined by what the customer wants, not by what you’re selling. Reflecting on this question can help you identify a higher purpose for the company through the eyes of the customer.

- When customers have a huge range of choices, why should they choose you? What would they do if you didn’t exist? You have to be able to answer the “why you” question with a unique and persuasive reason. If that doesn’t immediately jump out at you, try the “Five Whys” exercise. This is an iterative technique that helps you dig deeper on cause-and-effect relationships. You work your way backwards, asking “why” time and again until you get to the core.

Five Whys exercise

Let’s try a quick example of the Five Whys exercise. The Ordinary is a makeup company that sells affordable, back-to-basics skin care products is growing incredibly fast. In the three years since parent company Deciem launched the brand, they grew to nearly $300M in sales last year. Brand name recognition and sales volume have spiked.

- Why? The brand is taking off with budget-conscious Millennials over 30 who take interest in skincare.

- Why? None of their products cost more than $15.

- Why? Their products have only the most essential active ingredients – avoiding parabens, sulfates, mineral oil, formaldehyde, mercury, oxybenzone and a bunch of other ingredients I can’t pronounce.

- Why? This creates an affordable skin care regimen without scary unknown ingredients, all without animal testing, and without excess wasteful packaging.

- Why? This hits on several core morals and values of the Millennial skin care audience who want to minimize their impact/footprint, but without paying a premium to do it.

Competitive advantage takes many forms

Once you have done the due diligence of truly reflecting on these questions, examine your answers. Look for clues and patterns and start to formulate a plan for which areas have the most unique value to your customers.

There are typically several avenues a brand can take to own a certain customer benefit, audience segment, industry, or price point. Here are a few clues to watch for in the patterns. Are you the most personalized brand in your space? Do you have an incredible community with loyal advocates and rich conversation that people want to be a part of? Brands like Moz and Tableau seem to have this advantage in their spaces. Do you have a reputation for constant innovation, rapid evolution, and generally outsmarting the competition or disrupting an industry? Tesla is iconic for its innovation. Also consider things like supply chain efficiencies, breadth or depth in certain markets, the ratio of cost to value, your ethics or commitment to certain causes, and more.

Write a brand statement

Now that you’ve done your due diligence, it’s time to boil it down to a simple brand statement to make it crystal clear what your competitive advantage will be. Please note that this should not be a simple exercise. If it’s too easy, be skeptical of whether you have truly found your competitive advantage. Put in the work. Writing these statements is hard and takes time. And you should expect to revisit and revise over time as your competitive environment and customer preferences evolve.

Using the brand The Ordinary, I drafted an example competitive advantage statement: We, The Ordinary, create high-performing, minimalist skincare products so that cost- and cause-conscious skincare enthusiasts can have an ethical, effective skincare regimen without paying a premium price.

Then, check your work. Pressure test your brand statement. Does it meet the five criteria for competitive advantage? If not, keep digging. And once you have a clear competitive advantage statement, be sure to connect and reconnect with that intention, time and again.

Demonstrate: living your competitive advantage

Now that you’ve discovered your potential competitive advantage and chosen where to focus, it’s time to bring it to life. The difference between the average brand which merely puts a mission statement on their website and a brand with true, sustainable competitive advantage, is whether they walk the talk in every single thing they do. It has to be consistent with your products and services. It has to happen at all levels of a company. It has to be true in every moment you communicate with customers.

Once again, we find ourselves pressure-testing the competitive advantage. Can you realistically live this across departments, offices, teams, roles, initiatives, processes, marketing efforts and everything in between? You can’t be casual about competitive advantage. You have to be obsessed. Let’s talk about some questions you should ask yourself to activate your competitive advantage in every respect:

- How does this affect existing ways of working? What changes do you need to make to how you operate to live it fully? If you’re just now identifying your competitive advantage, which is totally ok!, you may have work to do in order to make sure it’s consistent across the organization.

- What are some things you won’t do in support of your advantage? These could be things you choose not to focus on, or things you will actively avoid.

- What team members can you bring together from across functions to activate this competitive advantage? Be sure to provide common language and targets for the team so you can all be united in action to drive better outcomes

- How will you prove your commitment to the competitive advantage outside the organization? Your team from top to bottom needs to fully believe and commit to this mission. But your customers also need to believe in your mission. Ask yourself what proof looks like. How will everyone know you are in fact achieving the competitive advantage you claim?

- What indicators can measure how you’re putting your competitive advantage to work in action? Make sure to define what “winning” looks like and establish a baseline for how you and the competition are doing. Create metrics and rewards that support the new purpose. Is it a high win:loss ratio of winning new business? A company size or revenue growth rate? Is it share-of-voice in an industry or among a certain audience segment? Is it perhaps retention of ideal clients and high referral rates? Know what you want to achieve, know how the competition currently measures up, and revisit these measurements regularly.

Defend: evolving your competitive advantage

Remember: competitive advantage is temporary. It’s a moving target, and that’s why it’s so difficult for brands to achieve and maintain. It’s important to understand the natural lifecycle of every business and industry.

The business lifecycle

I’ll reference the typical product lifecycle here — another MBA classic — and stretch it a bit to fit my point about defending competitive advantage.

When a new brand emerges with a new product, service, audience, or competitive advantage, much of the effort and investment is spent raising awareness and amassing your first customers. Then you start to build up preference for your brand and increase your market share. Competition may be lower at this stage, and you’re getting some scale, growing your audience. Then your steep growth trajectory starts to level off. The competition sees that you’re onto a good thing and they start cutting into your piece of the pie. You may fight it by adding more features, or perhaps you lower your price.

In a typical business, this is the point where sales may even start to decline. You have a choice here. You can maintain your existing service and try to rejuvenate it. You can cut costs to stay competitive, though that cuts into your profit margin and makes it less worthwhile. Or perhaps you decide to get out of the game entirely because it’s not financially attractive anymore.

Or, you can find new ways to achieve competitive advantage. You could explore new areas of expansion, or even completely reinvent yourself to renew your competitiveness. The cycle starts again, and once again you become the one that others want to catch up to.

Fight or flight or evolve?

You can only fight off the competition for so long doing the same things. Fighting isn’t always the answer. At some point you may need to evolve, and there are a few ways you might do that.

- You can explore new markets – are there under-served or untapped audiences you can reach?

- You can expand new, closely related product lines or services

- You can add new features or innovations to your existing service or product.

- Similarly can also and enhance and elevate existing benefits

- You can cut costs to produce or ship and find economies of scale, which drives price down, and makes your parity product more valuable relative to price.

- Or you can go through mergers and acquisitions (join forces) or even divest certain pieces of the business (stop offering) to be able to focus on a new competitive advantage.

This is hardly an exhaustive list, just a few thought starters on what evolution might look like if you are at this stage of your career, or if your business is at this point in its natural lifecycle.

In order to create, keep and defend sustainable competitive advantage long-term, evolution is necessary. Keep rooting out the opportunity for renewed competitive advantage and master the art of reinvention. If you can adapt and transform, you can compete and survive.